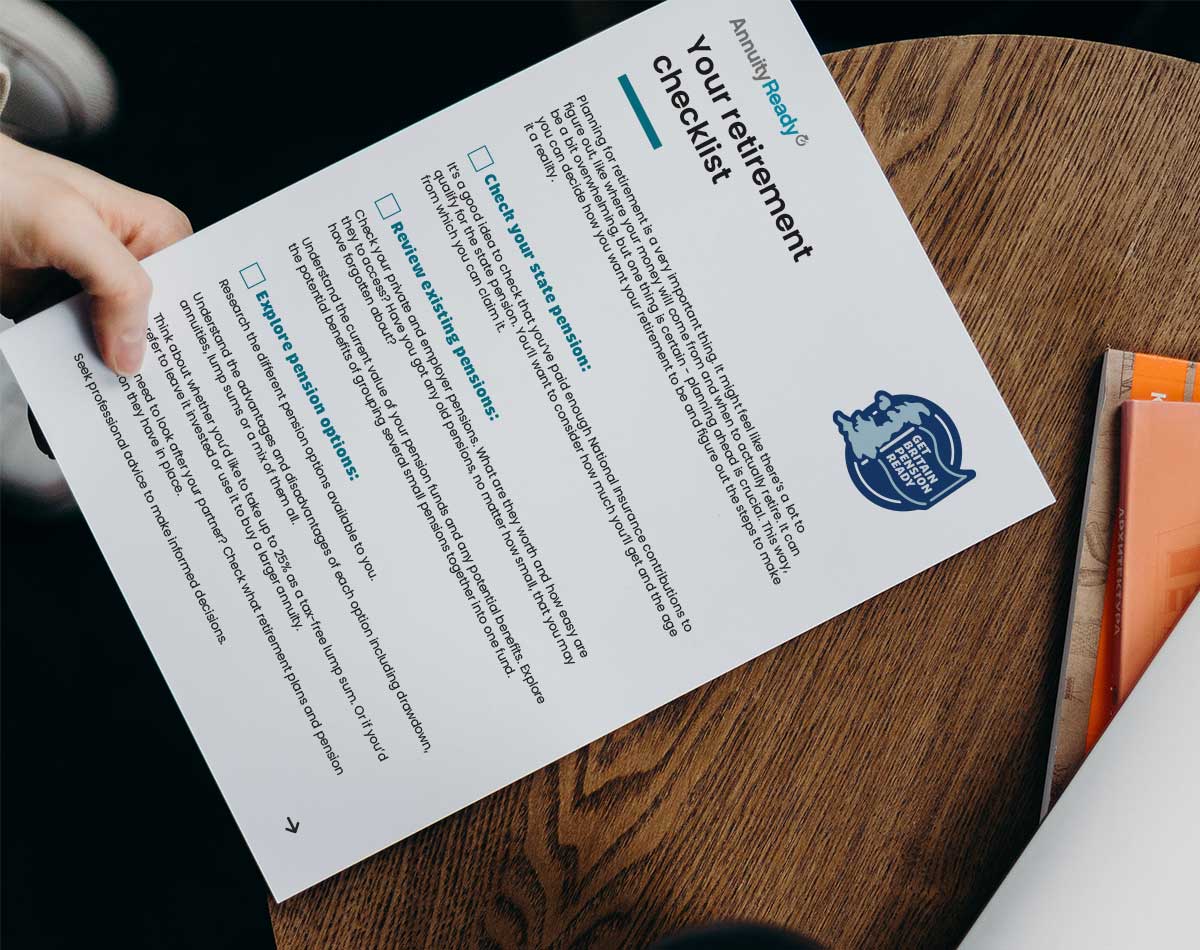

Planning for retirement is a very important thing. It might feel like there's a lot to figure out, like where your money will come from and when to actually retire. It can be a bit overwhelming, but one thing is certain - planning ahead is crucial. This way, you can decide how you want your retirement to be and figure out the steps to make it a reality.